Menu

ROUTING NUMBER: 307070050

Rest Confident, Your Money is Safe and Secure at Kirtland Credit Union, a message from our President & CEO. Learn More

We have engaged FORVIS, LLP (Attn: Jeff Rosno, 1801 California Street , Ste. 2900, Denver, CO 80202) to perform member verifications. Kindly compare the balance of your accounts on your December 2022 statement WITH YOUR RECORDS. If balances do not agree, please address your discrepancies directly to FORVIS, LLP. Include your name, truncated account number, and an explanation of the difference noted. A reply is not considered necessary unless a difference is noted.

Friday, March 15: the Kirtland CU branch on KAFB is CLOSED. We apologize for any inconvenience. Please visit our nearest Gibson branch for assistance.

Kirtland Credit Union will never ask you to provide, update, or verify personal or account information through an unsolicited email, phone call, or text message. If you receive an unsolicited email, phone call, or text message, DO NOT RESPOND. Notify us at (505) 254-4369 or 1-800-880-5328.

Online and Mobile Banking are intermittently unavailable. We are working to resolve the issue and apologize for any inconvenience.

Concerned about how a government shutdown may impact you? Call us at 1.800.880.5328 to discuss your needs.

ROUTING NUMBER: 307070050

By Ashleigh, K-Staff

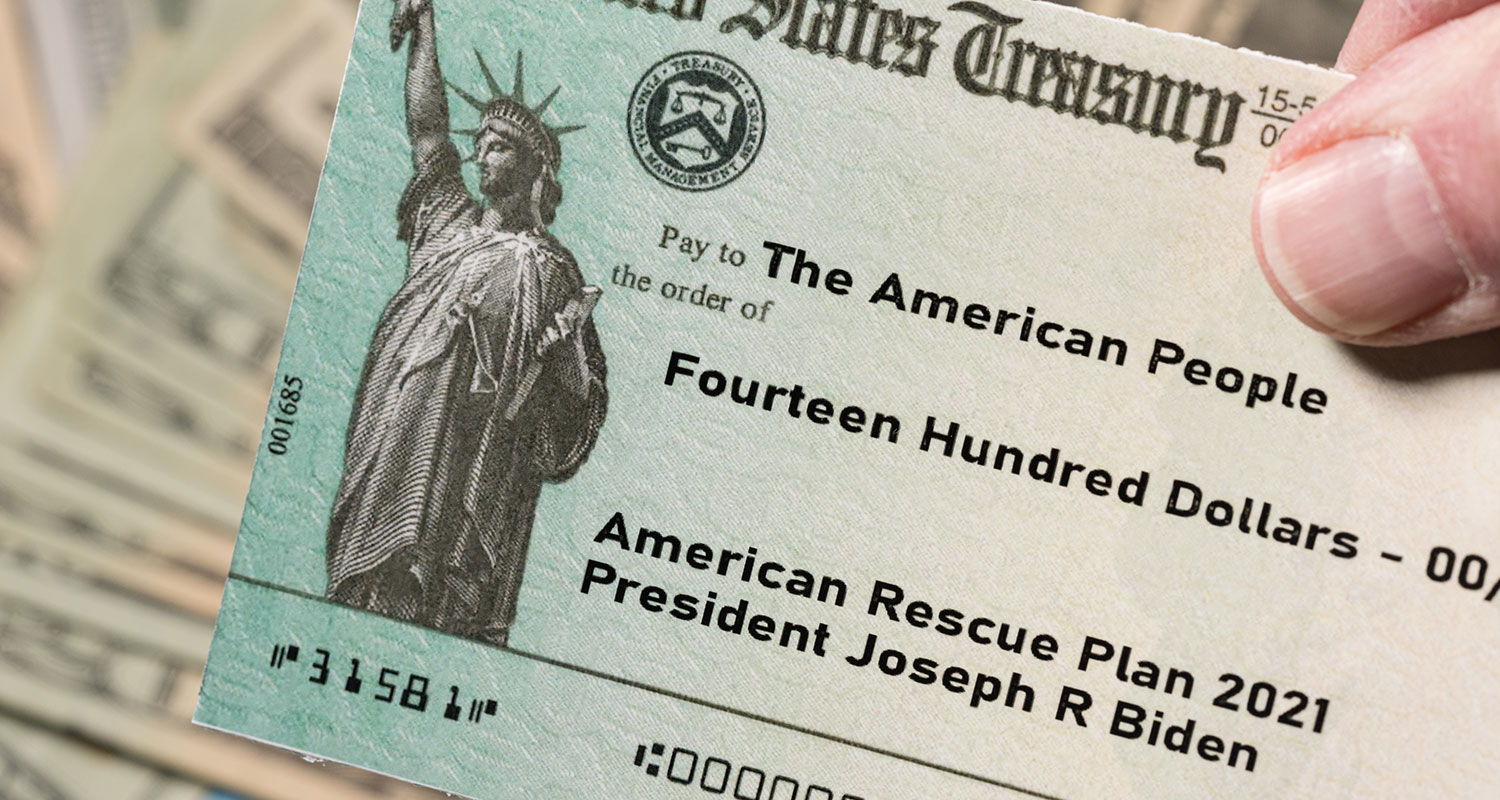

The U.S. Congress passed the third wave of federal relief—a.k.a., stimulus bill— on March 10, promising financial relief to individuals, businesses, states and local governments. And yes, most Americans will be getting another check from this particular package.

Well, that depends on how much money you made last year (if you’ve already filed your 2020 return) or the year before (if you haven’t yet filed). The thresholds for direct payments from the ARP have lower cutoffs than with previous bills, so some families who received a check in the last round will see either no check or a reduced amount.

Individuals earning up to $75,000 and couples earning up to $150,000 would receive the full direct payments of $1,400 per person. Individuals will also receive an additional $1,400 payment for each dependent claimed on their tax returns. For individuals making between $75,000 and $80,000 (and couples making between $150,000 and $160,000), a partial payment will go out. Individuals earning above $80,000 (or couples earning above $160,000) will not receive a direct payment at all.

That $1,400 includes any dependents as well. For example, a family of four whose parents make $80,000 and file jointly, can expect to receive $5,600 in direct payment from the ARP.

Due to an expanded Child Tax Credit included in the plan, that same family with children ages 8 and 5 will receive $2,600 more in tax credits than they did previously. The new Child Tax Credit is $3,000 for children ages 6–17 and $3,600 for children under 6. Right now, the plan is to issue a portion of the credit over the course of a year in the form of direct payments up to $300 per child per month. Congress has not yet decided how to execute this portion of the bill, however, and more information will be available soon. The payments would not start until mid-summer. The credit is, again, dependent on income. Couples with an income less than $150,000 a year (or $75,000 per year for an individual with a child) are eligible for the full credit amount.

Again, that depends. If you’ve previously authorized direct deposit with the government during tax filing in order to receive your refund, you can expect those direct payments to begin dropping automatically into those accounts as early as March 17.

The easiest way to keep track is to check the account listed with the IRS via Online or Mobile Banking. The IRS, as of March 11, 2021, says they are currently reviewing implementation plans, though with the president’s signature on Thursday, March 11, the IRS should have more information posted very soon. Kirtland Federal Credit Union will deposit Economic Impact Payments into your account upon receipt of the funds from the Federal Reserve.

If you are expecting a paper check, keep an eye on your mailbox for the next few weeks. Once you receive your direct payment (or are receiving your Child Tax Credit payments), you can deposit those checks quickly and easily with your phone or tablet with our Mobile Banking app. No need to come into a branch (unless you want to. We’d love to see you!)

Stay up to date with the latest COVID-19 updates by bookmarking the COVID-19 Updates page.

Connect With Us

Routing Number: 307070050

6440 Gibson Blvd. SE, Albuquerque, NM 87108

Federally insured by NCUA Equal Opportunity Lender